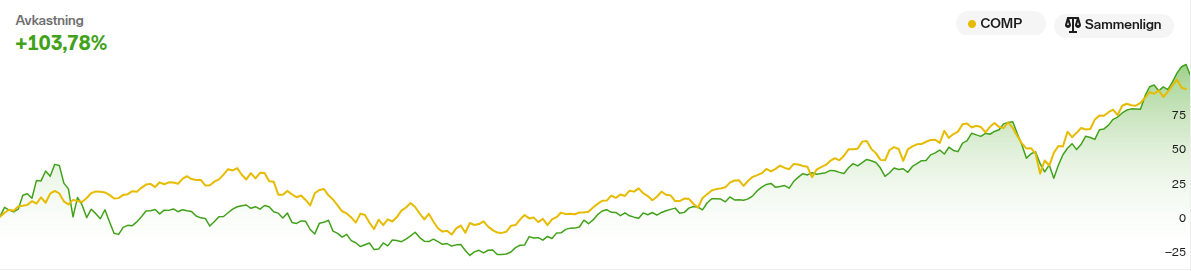

Annual return ~15.2%

From Nov. 16, 2020 to Nov. 16, 2025, my combined portfolios have garnered a total return of 103.78%, beating the Nasdaq Composite (93.17%, see yellow line in the picture) and S&P500 (89.29%) in the same time period. My total return since inception, based on today (Nov. 16, 2025) is at 108.61% (28. Aug, 2020).

I've had an interest in stocks and personal finance since the autumn of 2020. I started with zero experience, followed the crowd of friends, and invested in hype stocks. Things rose quickly, but then they fell even faster, and I went through months of severe distress. I realized something was fundamentally wrong when the market began climbing while my stocks kept plunging. I started educating myself, reading investment books, and following better advice. Perhaps most important was cutting out bad advice and the noise that helps no one.

In 2021 I took the losses from the hype stocks and moved the capital into more sensible things. I had enormous growth in 2020, and whenever I wonder why I didn’t sell while things were going well, I remind myself that the lessons I’ve gained since then are far more valuable. Not just for the stock market, but also for understanding how businesses function, what sound financial practice looks like, the difference between wealth and prosperity, and so on. The real gold is the wisdom that grows within oneself, because that never rusts: no one but you can keep your desires and impulses in check, and if you haven’t mastered that, you’re left completely exposed to the market’s psychopathy..

I keep learning and constantly evolve my strategy. I think it’s important to adapt techniques that are tailored to oneself, because investing is at its core a personal journey. I draw ideas from both large and small investors, among them Lynch, Buffett, Munger, Phil Town, Terry Smith, Joel Greenblatt, Tom Gayner, Nick Sleep, and others. My strategy is to own high-quality, value-creating companies. I use a tailored checklist that accounts for several calculations, the first of which is that what I own must be something I can understand. The motto is to own wonderful companies at a fair price rather than good companies at a wonderful price (borrowed from Charlie Munger). Whether it works, only time will tell … but I sleep soundly now.

© Filip Niklas 2024. All poetry rights reserved. Permission is hereby granted to freely copy and use notes about programming and any code.